Condo Insurance in and around Philadelphia

Condo unitowners of Philadelphia, State Farm has you covered.

State Farm can help you with condo insurance

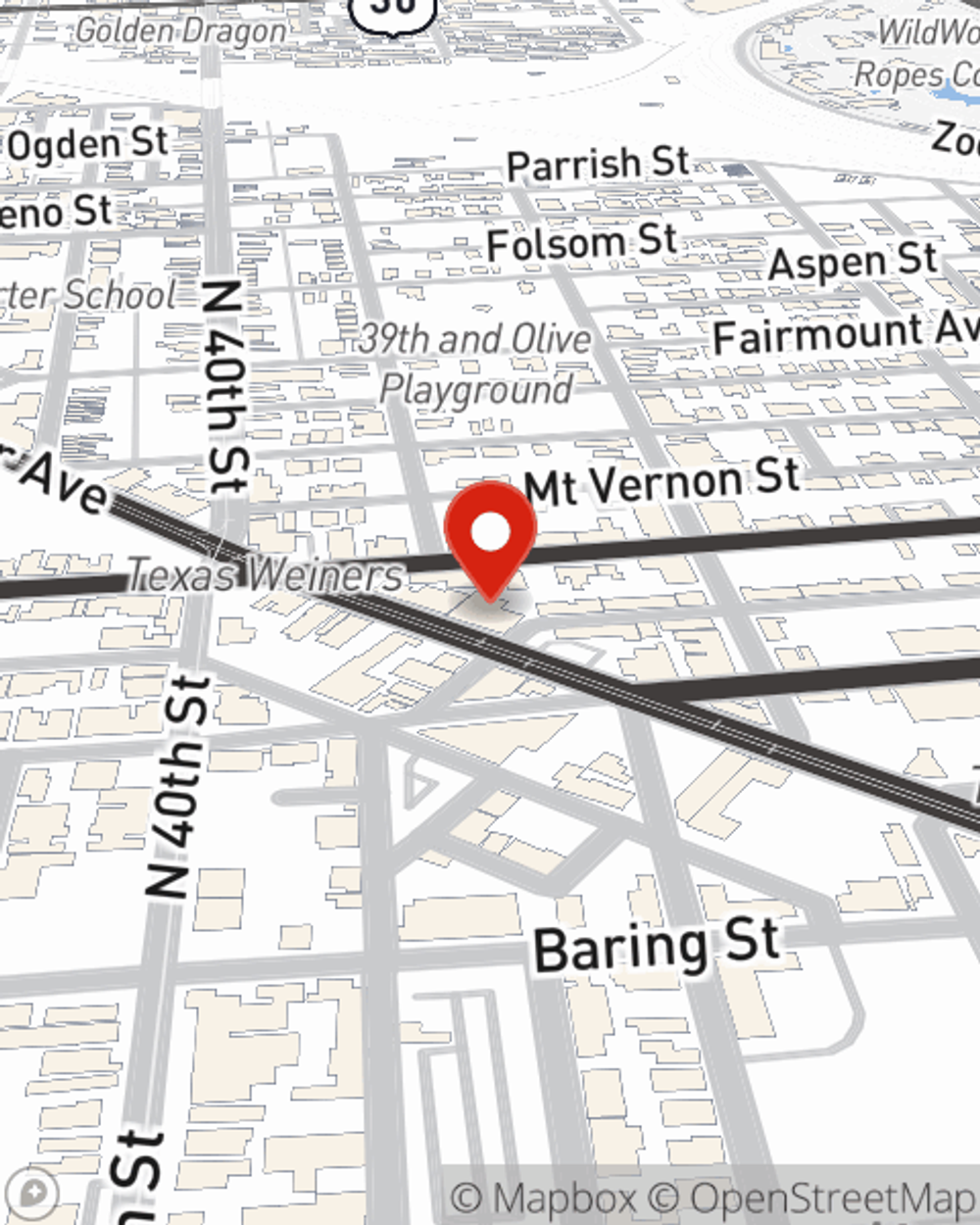

- Philadelphia

- West Philadelphia

- Philly

- West Philly

- University City

- Philadelphia County

- Pennsylvania

- New York

- Delaware

- New Jersey

- Chester County

- Montgomery County

- Delco

- Chesco

- Delaware County

- South Philadelphia

- South Philly

- Lancaster Avenue

- Upper Darby

There’s No Place Like Home

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from fire, freezing pipes, or wind.

Condo unitowners of Philadelphia, State Farm has you covered.

State Farm can help you with condo insurance

Condo Unitowners Insurance You Can Count On

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with terrific coverage that's right for you. State Farm agent Charles Berrouet can help you understand all the options, from possible discounts, bundling to a Personal Price Plan®.

If you want to learn more, State Farm agent Charles Berrouet is ready to help! Simply contact Charles Berrouet today and say you are interested in this terrific coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Charles at (215) 921-8029 or visit our FAQ page.

Simple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Charles Berrouet

State Farm® Insurance AgentSimple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.